Why LoanPigeon Exists

Loan intake doesn't fail because teams don't work hard — it fails because the process is unstructured. LoanPigeon provides a system that brings clarity, consistency, and completeness to every loan from the start.

No structure for intake requirements

Without defined templates, each loan starts differently. Required documents vary by memory, forms are inconsistent, and there's no clear standard for what makes an intake complete.

No visibility into progress

Intake progress lives in spreadsheets, sticky notes, or team members' heads. There's no centralized view of what's complete, what's missing, or what needs attention.

Manual follow-ups and tracking

Teams spend hours identifying gaps and chasing missing documents. Follow-ups rely on manual tracking and memory rather than clear visibility into what's needed.

How LoanPigeon Works

Templates define intake requirements upfront. Borrowers complete guided portals, and progress is tracked from start to finish.

1. Create Intake Templates

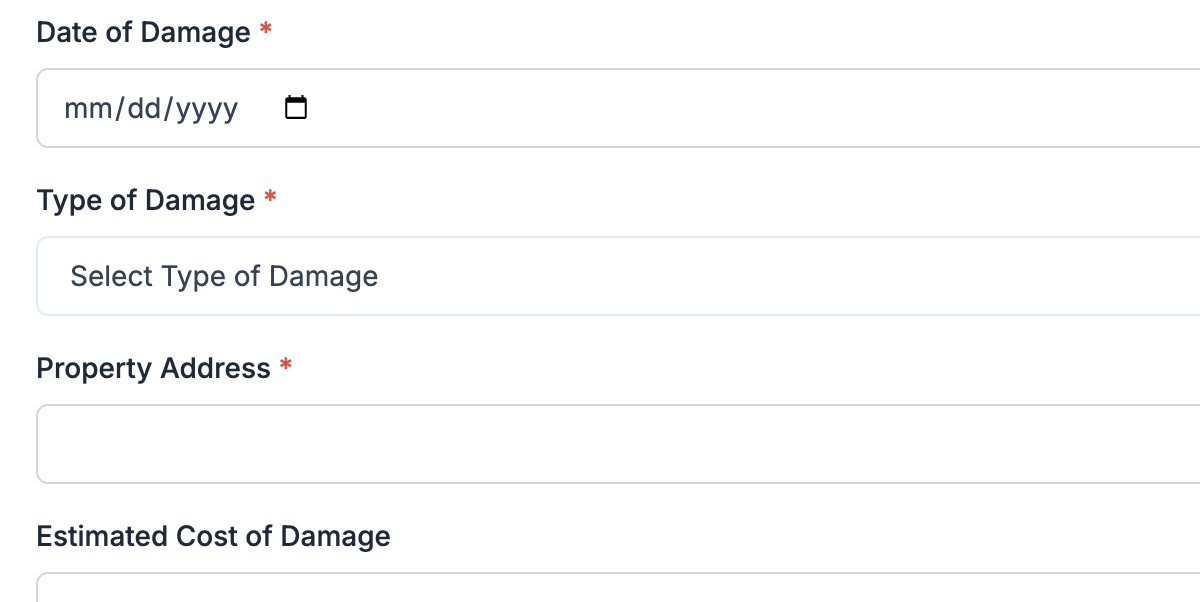

Define intake templates that specify required documents, intake forms (single or multi-form packets), provided documents, and workflows.

2. Borrowers Complete Guided Intake

Borrowers access a guided portal that walks them through required forms and document uploads, with progress indicators and next steps.

3. Progress Is Tracked

Intake progress and completeness are tracked. The workspace shows what's complete, what's missing, and what needs attention.

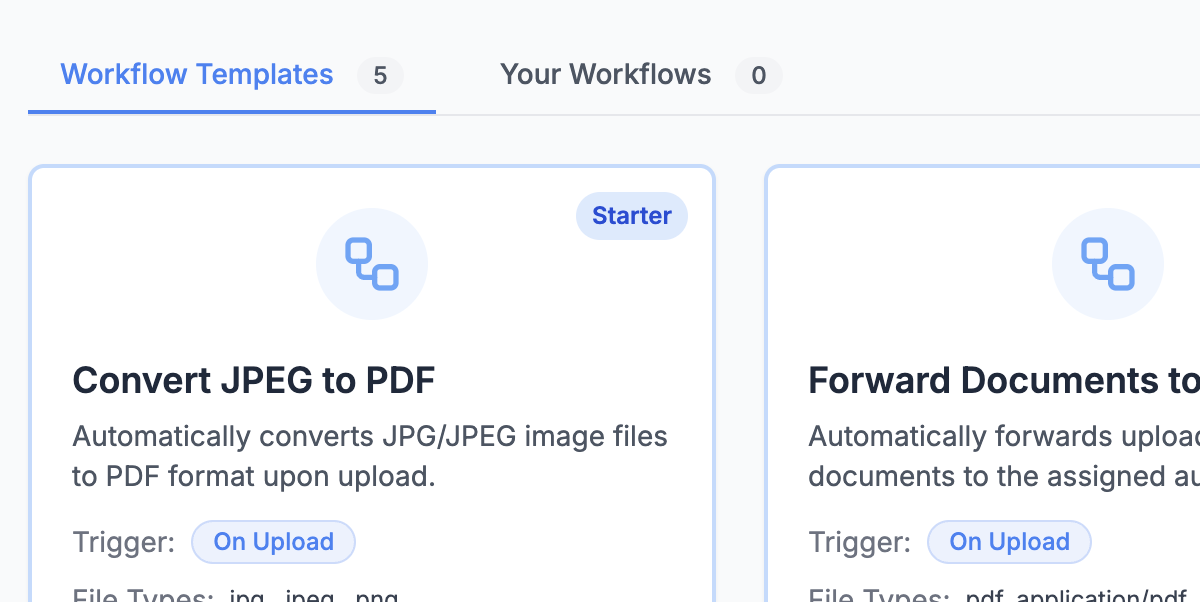

4. Workflows Trigger

Workflows trigger based on intake activity and completeness — sending reminders, updating status, or assigning tasks when conditions are met.

5. Start Loans with Structure

Every intake follows the same process. Your team knows what's complete, what's missing, and can start loans with clarity and confidence.

The Difference Is Night and Day

The difference: clarity replaces guessing, consistency replaces one-off processes, and visibility replaces chaos.

Before LoanPigeon

- No structure — each intake starts differently, requirements vary by memory

- Guessing what's missing — no visibility into progress or completeness

- One-off processes — tracking in spreadsheets, sticky notes, or team members' heads

- Manual follow-ups — hours spent identifying gaps and chasing missing documents

After LoanPigeon

- Templates — consistent intake requirements defined upfront

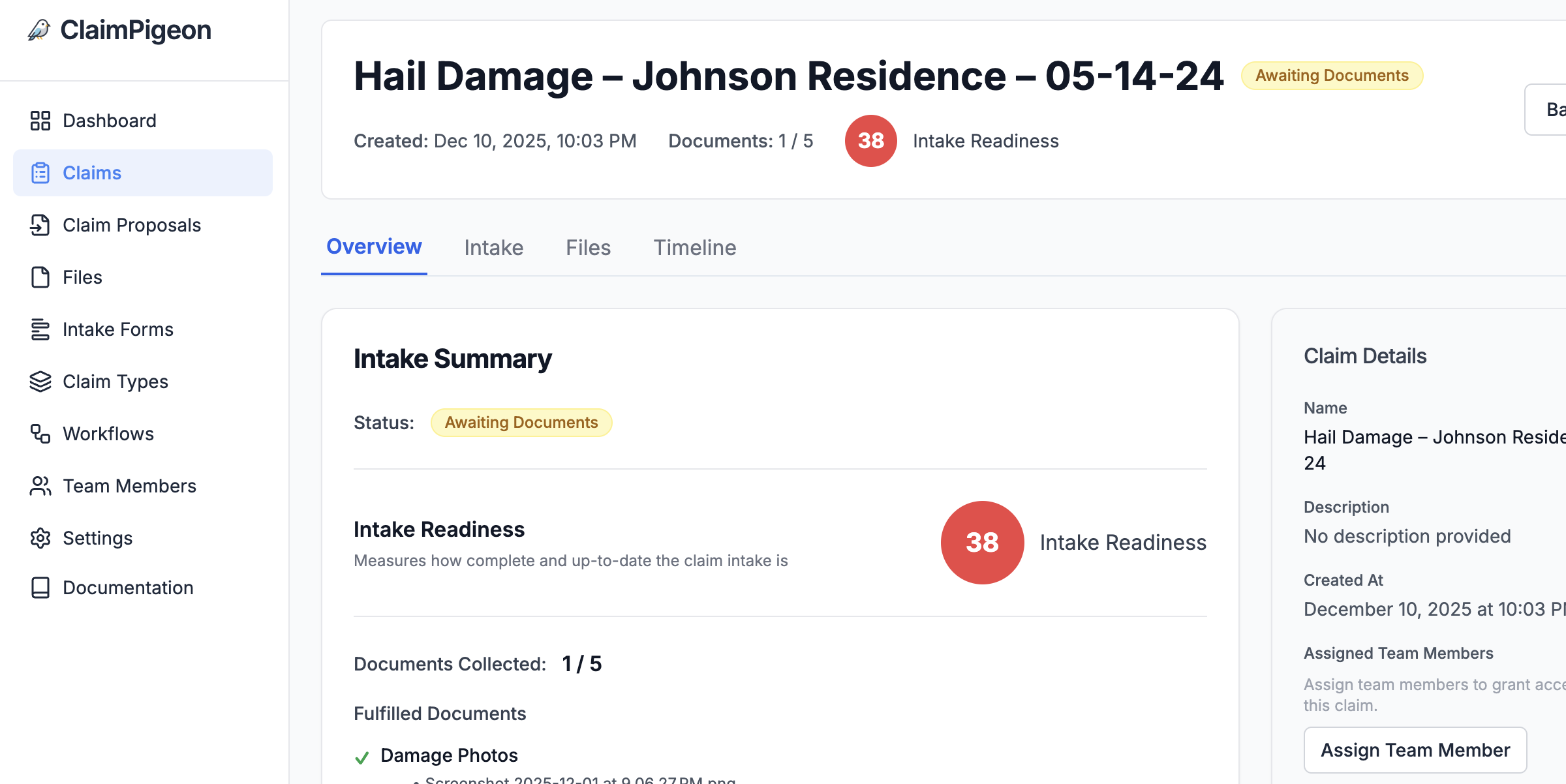

- Clear visibility — see what's complete, what's missing, what needs action

- Clear intake status indicators show exactly what’s complete

- Progress tracking — progress and completeness monitored

Structured Intake Features

LoanPigeon provides structure, visibility, and automation to ensure every intake is complete, consistent, and predictable.

Loan Intake Workspace

Each intake has a dedicated workspace showing required documents, submitted files, intake forms are organized into a clean, centralized intake workspace. See what’s complete, what’s missing, and what needs action.

Template-Driven Intake

Define intake templates that specify required documents, intake forms (single or multi-form packets), provided documents, and workflows. Every intake follows the same process.

Guided Borrower Intake Portals

Borrowers access a guided portal that walks them through required forms and document uploads, giving your team a clear record of what’s happened and what’s still outstanding.

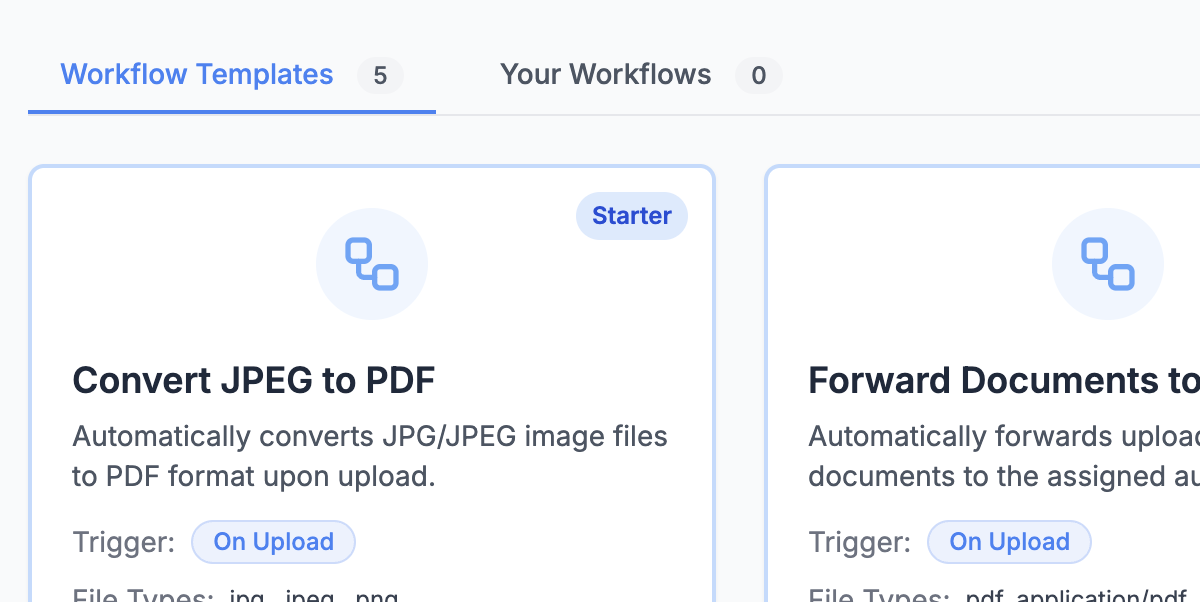

Workflow Automation

Workflows trigger based on intake activity and completeness — sending reminders when documents are missing, updating status when milestones are reached, or assigning tasks to team members.

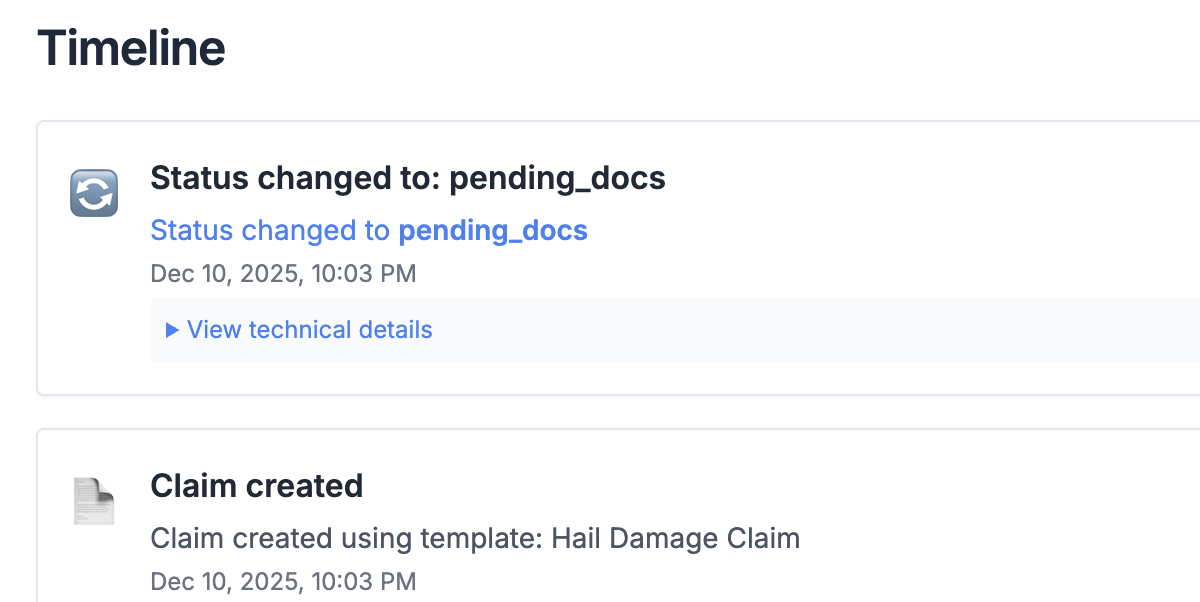

Activity & Audit History

Every upload, form submission, workflow action, and status change is logged with timestamps. Your team has a complete audit trail of intake activity.